Inventory Costing Methods in Accentis Enterprise

In Accentis Enterprise, every inventory item that is designated as a stock item can have a quantity in stock and a total value in stock. When any transaction occurs that affects the quantity in stock, it will also affect the total value of that stock. For example, when you buy more stock and receive it into inventory through a goods Receive transaction, both the quantity and total value of that item will generally increase. When you deliver stock to a customer and remove it from inventory, both the quantity and total value of the stock will generally decrease.

At any point in time and for stock items only, the total value of stock divided by its total quantity in stock is referred to as the item’s Average Cost. If there is no quantity in stock of an item, its average cost is always zero. These calculations are on a per-warehouse basis; the average cost of an item code in one warehouse may not be the same as the average cost of the same item code in a different warehouse.

When an item is placed into stock (received, manufactured or adjusted), its cost per unit may be different to the last time it was placed into stock. Accentis Enterprise can be configured to manage an item’s “cost each” using one of several different costing methodologies, as follows:

- Moving Weighted Average Cost (MWAC)

- Specific Cost (Serial or Batch tracking)

- Specific Cost / MWAC hybrid.

- Discretionary First-In/First-Out (FIFO - variant of Specific Cost)

- Standard Cost

The table below summarises the use of each method, its advantages and disadvantages (GP = Gross Profit):

|

Method |

Usage |

Advantages |

Disadvantages |

|---|---|---|---|

|

Moving Weighted Average Cost (MWAC) |

Most common method of costing. Used when supplier prices are stable and there is constant throughput of stock |

|

|

|

Specific Cost |

Used when exact cost of item purchased must be recognised in GP. Also used as a consequence of serial/batch tracking an item |

|

|

|

Specific Cost / MWAC hybrid |

Used when you want advantages of both methods |

|

|

|

Discretionary FIFO |

Used as a consequence of FIFO tracking for other reasons |

|

|

|

Standard Cost |

Used when there are fluctuations in purchase price that you do not want to flush through to your GP |

|

|

Note: GP is the gross profit recognised when an item is sold.

Different methods of costing and valuing inventory

Moving Weighted Average Cost

The Moving Weighted Average Cost (MWAC) is a perpetual, moving, weighted calculation of inventory and is generally used where it is not possible to distinguish which items in stock have been bought from which purchases. That is, they are mixed together, not batch or serial tracked, and when an item is consumed from inventory you don’t know if that item was from the first purchase or the most recent purchase.

The MWAC is recalculated for an individual item every time stock is added. As more and more items are bought, the MWAC moves closer and closer to the purchase price, in comparison to the ratio of the quantity of items bought versus the quantity of items still in stock at the time of purchase. When stock is consumed, it is consumed at the current weighted average cost.

When an item is purchased, MWAC is calculated as follows:

MWAC = (value_of_stock_before_purchase + value_of_new_stock_purchased) / (quantity_of_stock_before_purchase + quantity_of_new_stock_purchased)

Facts about MWAC

- MWAC is one of the most common costing methods used. As a simple example: Buy 10 apples at $1 each, then buy another 10 apples at $2 each. This results in 20 apples at a combined cost of $30, which equates to a $1.50 MWAC.

- At all times, Accentis Enterprise stores the total value of stock and the total quantity of stock to divide and determine the average cost, thus avoiding compounding rounding errors on a stored MWAC.

- Once a stock level reaches zero, the next time it is purchased, the average cost of the item will be equal to the purchase price of the item.

- MWAC provides a dampening of peaks and troughs in your buy price and has the effect of smoothing your effective cost (and therefore your profit margin) while maintaining a correlation to actual purchase price. This allows the absorption of one-off spikes.

- The MWAC concept doesn’t honour “special” or spot pricing for a specific sale. That is, if you have been granted a special price on a large purchase of goods specifically for a sale to a customer, the special pricing will be absorbed into the MWAC resulting in a lower GP than expected on that specific sale (and a higher GP on subsequent sales to other customers). Recognition of a specific GP from special sale-based purchasing must be done using the Specific Cost / MWAC hybrid method.

Specific Cost (Serial or Batch tracking)

Specific Cost is a method of tracking the actual, specific purchase price of any individual item of stock.

Specific Cost is usually used with either high value, low volume items because of the logistics involved with maintaining the tracking for every movement of an item, or with items that are tracked for logistical/tracking and not costing purposes. It is often used in a production environment for finished goods which have a high value or where end-user tracking is required, with batch tracking being used for the consumption of raw materials.

When using Specific Cost, every movement of an item code using this method must be accompanied with the specific serial or batch number (and therefore cost) being transacted.

Examples of where specific costing would be used in practice:

- electrical or electronic components (controllers, whitegoods)

- automotive or machinery (cars, trucks, machines, parts)

- engineering (concrete beams, steel assemblies)

- aviation (discrete parts, assemblies, units)

- food, pharmaceuticals or any industry required to track raw materials.

Specific Cost / MWAC hybrid

Specific Cost / MWAC hybrid is a method of tracking Moving Weighted Average Cost but narrowed down to a specific batch of items within the one item code. Each different batch of the same item code will have its own MWAC. If only one purchase is made for a specific batch, then the MWAC for that batch is also the exact purchase price of the goods.

For example, let’s say you batch track an item code for billets of steel. Each time you purchase more billets, those billets belong to a specific batch based on the mill’s heat certificate. When you receive this product into the system from a purchase, you will assign a batch number to it, and the actual cost of that batch purchased is stored by Accentis Enterprise.

When consuming billet steel, the operator must tell Accentis Enterprise which batch they are consuming and what quantity. Therefore, we know the cost of the batch of steel that is being used. If the batch in question was only purchased once, then we also know the exact purchase price at the point of consumption.

Multiple purchases of the same batch

In situations where you receive multiple shipments from different suppliers of the same batch of goods, when those goods are assigned a batch number, the cost is combined with any other items of the same batch using an MWAC calculation. Since you can’t tell exactly which items from the batch are being consumed at any one time (because they all have the same batch #), you must consume items from this batch at a weighted average cost.

Examples of where Specific Cost / MWAC is used in practice:

- food: flour, butter, sugar, eggs (where tracking and chain of custody is required)

- industrial fabrication: plastic (resin, pipe), aluminium/steel (billets, rolls where QC is required)

- timber: laminated beams (consumed or sold per metre)

- electronics: components, circuit boards

- high value commodities: brass, copper, precious metals.

Discretionary FIFO

Discretionary FIFO is a first-in, first-out costing methodology at the discretion of the user. That is, with date-stamped batch tracking turned on, FIFO costing and consumption is available and recommended by the system but can be overridden by a user with sufficient privileges to select a newer batch (and therefore a more recent cost).

Accentis Enterprise will not mandate strict FIFO but rather recommend the ordering based on your own requirements. For example, your picking tickets will generally print the suggested batch number to consume based on your own FIFO rules, such as the use-by date of a product rather than the date on which it was actually received.

Standard Cost

Standard Cost is a method of using a standardised cost for an item and periodically revaluing your inventory to bring it back closer to its actual cost. This is achieved by assigning a standard cost to an item (which has usually been calculated using historical data) and then using that cost for all transactions instead of the actual cost of purchase.

Whenever goods are purchased for an item that has been assigned a Standard Cost, the difference between the actual purchase cost and the Standard Cost is posted to a Purchase Price Variance (PPV) account. Stock is always consumed at the Standard Cost. A special section at the end of this document explains more about Standard Cost.

Standard Costing is typically used when your purchase price fluctuates regularly (due to exchange rates or volatile pricing) and you want to assign a fixed cost to use for your sales and production reporting.

Facts about Standard Cost

- Standard Cost x Quantity in stock = Total stock value

- Your production costs will be constant for all items consumed at a Standard Cost, even if their purchase price varies.

- You must periodically revalue and account for the cumulative PPV, otherwise your total stock value may not be anywhere close to your actual purchase price. If not managed properly, significant costing anomalies can arise.

Viewing the value of inventory in your system

At any point in time you can see a full list of inventory in stock and the associated cost of each item by using Inventory > Report > Valuation > Valuation detailed (by item/warehouse) (report ID SA3548). This report has many filters to narrow down your results, and shows columns indicating your current average cost, quantity and other key information.

If no filters are applied, the total value shown on this report represents the total value of inventory in your system.

Standard Costing in Accentis Enterprise

Facts about Standard Costing

- Standard Costing fixes the cost price of an inventory item so that all transactions (and therefore profit margin) associated with the item use the same cost each time until that Standard Cost is changed. The effect is greater uniformity in reporting and analysis, forecasting and sales margin prediction, particularly when your buy price (especially from foreign sources) fluctuates rapidly.

- A Standard Cost can be set on an individual item code basis, and applies to all such items across all warehouses.

- If an item does not have a Standard Cost set for it, then no Standard Cost features or transactions will occur for that item, otherwise:

- an item’s Standard Cost is always equal to its Average Cost where there is a quantity in stock

- the Standard Cost of an item multiplied by the Quantity in stock will equal the total stock value

- all transactions in and out of stock use the item’s Standard Cost

Operation of Standard Costing in Accentis Enterprise

- All transactions of outgoing goods (e.g. Dispatch, Stock Assignment) will use the Standard Cost of the item.

- All transactions of incoming goods (e.g. Receive, Work Order) will use the Standard Cost to place the goods into stock but also insert an additional inventory transaction for the difference (called Materials Variance) to reconcile back to the actual cost of the originating transaction.

- Example: A widget has a Standard Cost of $5. Purchase goods for $8 and receive into stock. There will be a receive transaction for $8 PLUS a Standard Cost Variance transaction for -$3, ensuring that the net value added to stock is only $5. The variance of -$3 is posted to a Standard Cost Variance general ledger account.

- If you produce goods using work orders, the finished goods are placed into stock at the item’s Standard Cost and both a Labour Variance and Materials Variance transaction may be inserted to reconcile back to the actual labour/materials cost (explained in detail below).

- The Standard Cost of items should be monitored regularly to ensure that their cost does not deviate too far from current purchase prices.

How to set up Standard Costing

Three settings need to be adjusted to allow you to use Standard Costing; these are:

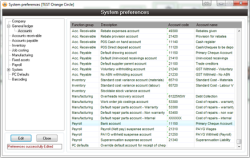

1. System preferences

Inventory > Allow use of Standard cost for stock items

You must have this option on to be able to use the Standard Costing system. This option exists to prevent users from accidentally setting Standard Costs against an item without fully understanding its use.

2. General ledger accounts for Materials Variance and Labour Variance accounts

The Materials Variance account is used to post variance for any materials received into stock or produced via a work order. The Labour Variance account is only used to post the variance of the labour component for work orders (explained below). Both of these accounts are typically expense or cost accounts.

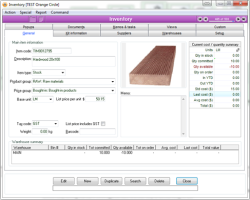

3. Set item Standard Cost on individual item codes

Each item code has its own Standard Cost setting. It can be set completely independently from any other item code.

Each item requiring a Standard Cost can be entered whilst in Edit mode. These values can also be imported from a spreadsheet (contact Accentis Support for details).

How inventory transactions operate with Standard Costing

Receiving goods into stock

The Receive inventory transaction is posted using the value on the purchase order/invoice, and a Standard Cost Variance transaction is posted to reconcile to the item’s Standard Cost. Goods are placed into stock at the Standard Cost and the difference from the purchase price (Material Price Variance) is posted to the Standard Cost Materials Variance G/L account.

Dispatching goods

Dispatch transactions extract from inventory at the item’s Standard Cost. There is no additional posting of cost difference to any accounts.

Manufacturing goods with work orders

When items are manufactured or assembled using work orders in Accentis Enterprise:

- any manufacture or assembly of an item using a work order is placed into stock at its Standard Cost. It is assumed that this Standard Cost is made up of Standard Labour Costs and Standard Non-labour costs (materials and overheads).

- the Actual Manufactured Cost of an item is a combination of the cost of labour from timesheets plus other costs (bill of materials, overheads, job costs)

- the Actual Labour Cost for a work order is calculated from the cost of all timesheet entries posted to the work order at the time it is finished less any previous actual labour costs applied to any previous Finish transactions for that work order

- the Actual Non-labour Cost for a work order is calculated as the total finished cost of the work order at the time it is finished (see Work Order Costing Methodology for a full explanation of all of these costs) less any previous actual non-labour costs applied to any previous Finish transactions.

On finishing a work order in Accentis Enterprise for an item that has a Standard Cost:

- the variance between the actual labour cost (from timesheets) and the estimated labour cost (from the item) is posted to the Labour Variance Account in the general ledger

- the variance between the actual non-labour costs and the standard non-labour cost is posted to the Materials Variance Account in the general ledger

Other transactions that add goods to stock

All other transactions which add goods to stock will add the goods at their Standard Cost and post a variance transaction to reconcile back to the actual cost specified in the transaction.

Other transactions that remove goods from stock

All other transactions which remove goods from stock will remove the goods at their Standard Cost.

Changing an item’s Standard Cost

The Standard Cost of an item can only be changed when there are none in stock (i.e. the item’s Qty in stock is 0). If there are none in stock, the Std Cost field can be edited directly from the Inventory form.

Q & A

Which costing method should be used for my business?

The costing method that you use for your business will almost certainly differ depending on the actual item in question. The costing method used will be determined from a combination of factors, such as:

- the relative value of the item (high or low)

- how frequently the purchase price changes

- how much the purchase price fluctuates between purchases

- the rate of consumption of the item

- the shelf life of the item

- the logistics of tracking or assigning a batch/serial number

- your own QA or tracking requirements for the item

- your specific board reporting requirements or company costing policy.

The method chosen for costing may have a significant impact on the physical management, movement, storage and labelling requirements for your inventory, so if you are uncertain as to which method to use, you should discuss it with an Accentis Support team member and/or your accountant.

Can costing methods be changed?

Yes. Once a certain costing method has been used, you can change to a different costing method. However, you must consider the impact of the change on historical reporting. For example, if you change your costing method from MWAC to Specific Cost (serial tracked), your historical data will not contain serial # history.

How do I force the current MWAC of an item to be a certain value?

At any point in time, you can force the current MWAC of an item to a certain value by using a Stock Revaluation transaction. When performing this transaction on a single item code, the variance between the current total value and the new total value is posted to an adjustment account of your choice.

You would typically revalue inventory if either:

- a past transaction was done at an incorrect price and you have locked the period.

- you haven’t purchased stock for a long time and you want to reflect the current purchase price of the item.

- you want to devalue the item because of its age or obsolescence.

Keep in mind that once an MWAC item has been revalued, the next purchase will produce a recalculated MWAC based on the new purchase price and the recently revalued price.

If I have been using Standard Cost, can I change to use MWAC?

Yes. All you need to do is to ensure that you have a quantity of zero stock of that item, then Edit the item and delete (do not set to 0, this is not the same thing) the item’s Standard Cost field, then update.

How frequently should I update an item’s Standard Cost?

You should update an item’s Standard Cost at least annually, but this can be done any time you like. The frequency of standard cost updates and the revised value of your Standard Costs is something that should involve careful planning.

Why can't I just say that an item now costs the same as my last purchase price?

When you are looking at the value of an item in stock, there’s often a desire to say “Can I just pretend the cost of the item is always equal to the last purchase cost”? But the reality is that some of the stock might not have been bought at that last cost. The value (or “current” cost) of any stock item is based on prior transactions that put that item into stock, and typically an average value of those transactions.

For example, you purchase an item for $7 then after a new arrangement purchase the same item for $5. While you may want to say the item now only costs $5, and that's the value that you want to use when consuming the item, it didn't cost you $5 for all of them. That extra value has to be accounted for somewhere.

Your options in this example are:

- Revalue the item to $5, and the extra value is put into a write-off account.

- You batch track the item so that you have a $5 batch and a $7 batch. This way you can choose which one to consume at any point.

- Use standard costing and set the cost of the item to $5. This way, no matter what it actually costs, you will always consume it at $5. The difference is then put into your Standard cost variance account (materials).